Terminals play a new role, going beyond payments

Initially, payment terminals were designed to accept electronic payments through credit and debit card including PIN entry. Then, contactless came onto the scene and soon enough, the world began to embrace contactless (NFC) bank cards and digital wallets. The common thread: terminal hardware has been utilised for payments, and payments only. But this is changing rapidly.

Android-powered payment terminals are changing the game

Payment terminals have now entered the market which are built on the Android operating system (OS), and this opens up a new world of possibilities. While this technology has been in play for some time, it’s only now becoming popular in the payments industry.

Put simply, Android terminals can run Android applications, and this allows payment providers to offer hardware that can accept payment and perform many new complementary functions. A payment terminal is a tangible point of interaction, and with its functionality expanding beyond payment acceptance, businesses now have many new ways to add value for their customers – without having to add new hardware components.

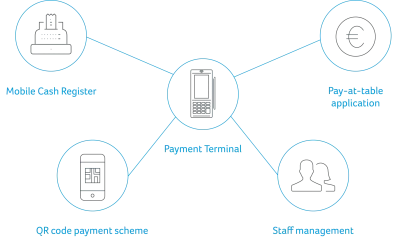

From a payment standpoint, this might be a mobile cash register application, a pay-at-table application (for hospitality), or QR code payment schemes. And the potential goes much further, because merchants can use the same hardware to power apps for staff management, stock management, customer loyalty schemes, tax-free selling, scheduling and planning, and much more. These solutions can help all types of business, or they can be industry or sector-specific.

Moreover, this gives merchants more flexibility to have their own custom app developed for a business use case that supports their very specific brand experience.

Payment industry stakeholders are responding to market needs

As barriers to accepting digital payment become lower, for example through software-based smartphone POS systems and peer-to-peer payment apps, using Android OS makes sense for the industry.

“These solutions are complementary,” said Conor Devane in our CCV Exchange webinar. “By powering terminals with Android, you can maintain a homogeneous app portfolio across devices and give merchants extra flexibility as they switch between types of hardware.”

In fact, flexibility is the main advantage. Most merchants will start with a single app, probably payment-focused. But over time, as the app stores go from strength to strength and awareness grows, they’ll venture into other areas. And with Android terminals, merchants are able to download apps from an app store, or centrally “push” an app to multiple terminals within their organisation. This is extremely powerful for larger businesses with hundreds of devices.

For B2B app developers, and for PSPs and acquirers, Android terminals represent a huge opportunity. The ease of building an Android app versus a custombuilt application for a proprietary OS means they’re able to try out new products quicker and cheaper, and without too much risk. This will encourage greater innovation in the industry over the coming years.

“…a range of innovative new solutions for different sectors and business use cases. It’s just the beginning right now, and there’s a lot more to look forward to.”

Marisa Ascher

Commercial Product Manager

Mobile Apps & App Store

“When I speak to app development partners in our network, there really is a lot of excitement about the new generation of terminals. They can’t wait until Android terminals become more widespread, so they can start to build a range of innovative new solutions for different sectors and business use cases. It’s just the beginning right now, and there’s a lot more to look forward to.”

Learn more? Read about 2021 Payment Trends in our CCV Pulse

Discover the full report!