How the right payment solution can help you make money out of your entrepreneurial itch!

“Payment is the essential part of doing business”

To make sure this article is for you, think about the following statements… If you answer YES to some or all of the below then you’re in the right place:

- You have this entrepreneurial itch for a while. It is like “I should… can I… etc”.

- You have a business idea. It is really great…

- You had a hobby for a long time, and you want to take it a step further

- You want to do what you love.

- You want to start a business on the side

- You want to realise a long-time dream – your own business

- You want to open your own store and sell your products

And the list goes on…

The key here is that you want to start a small business (or already started one) and want to know how to turn your idea into a source of income. What you really need is some direction and of course a good understanding of the best ways to get paid! Right? Well we’re here to help!

The first steps…

Initially, you want to start small and then scale up! Once your products or services are available on the market and you have customers buying from you, a big part of your sustainability will depend on what payment solutions do you offer!

Why choosing the right payment solution is so important?

The payment solutions you offer can play a major role in the success of your business. So you need to understand which payment methods people who will buy from you want to use. Even if customers are interested in your products, if you don’t offer their chosen payment method, you can lose the sale.

At first, maybe you want to just accept cash? That’s ok, however this method can be limiting, especially as consumers shift towards cashless and more convenient payment methods. It is very important to be relevant to your audience.

So, what’s the best payment solution for YOUR small business?

With lots of payment processing options available to choose from, it can be a complicated and confusing decision, but it doesn’t need to be!

A couple of questions to ask yourself first:

What payment methods do you think will be relevant to you? Who is your target audience? How would they like to pay? What would be easiest for them? And of course, for you?

Once you have the answers, you will have a gist of which is the most reliable, easy to use service provider for your business. Below we use Switzerland as example, but you can find similar information from Belgium, Netherlands. and Germany.

Preferred payment methods in Switzerland

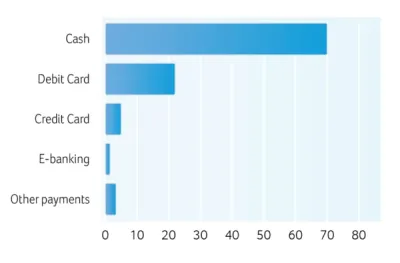

Figure 1.1 / Source: SNBBased on the above infographic, it appears that cash is the most frequently used payment instrument of households accounting for a share of 70%, followed by debit cards (22%) and credit cards (5%).According to the survey, the choice of method is also influenced by the amount the customer has to pay. Cash is of high importance for small payments, while debit cards are commonly used for medium-sized amounts and credit cards for larger amounts.

- CHF < 50 – Cash and payment apps

- CHF 50 – 200 – Debit card

- CHF 200 – Credit Card

Clearly, cash is still king in Switzerland! In fact, on average people hold CHF 133 in their wallet, which is a lot!!

Another interesting fact: “Residents of Ticino have a higher tendency to pay in cash than any other region in the country. By contrast, residents of French-speaking Switzerland opt for cashless methods of payment”! Yes, even the region can play a part…

But that’s slowly changing! Although newer payment methods are still not widely used in the country, according to the survey’s findings, preferences are shifting! It just depends who do you ask!

Age matters!

The age of customers also has a significant impact on the method of payment they would choose. SNB’s survey found that people aged 55+ prefer to pay with cash, while people aged between 15 -34 recorded a tendency for card payments.

What cashless payments do people like to use?

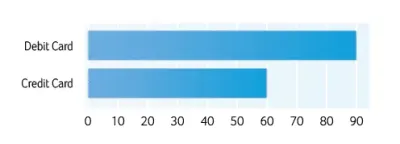

Debit cards (Maestro/EC card, PostFinance card) is recorded to be the most commonly used cashless payment method, with 90% of people owning a debit card compared to 60% who own a credit card (Figure 2).

The future of payments?

Ever heard of NFC or Near Field Communication? Well it is the technology that makes contactless payments happen! If you haven’t thought about it for your business, maybe you should reconsider, for several reasons!

Today you can pay up to CHF 40 via contactless in Switzerland, meaning you only put the card close to the card reader (terminal) to register the purchase/transaction and ‘Voila’ the payment is complete! Can you imagine how much time will this save a customer, especially if they were in a hurry?

To enable NFC on the terminals is especially useful for small businesses that operate during rush hours.

The above findings provide a hindsight of the Swiss Customer’s preferred payment methods. While that’s a critical factor to consider when choosing, you must also think about your business model and current operational constraints and needs.

Some of the benefits of cashless payment methods include:

- Better Security/ less fraud

- Less need for keeping change

- Less need to handle cash

- Faster to use in rush hour

- Freedom of choice, with cashless options

- Better Control! You can track transactions in real time

What you need to go cashless (and let’s start small) in three simplified steps:

- A card reader to manage card payments:

You will need a contract with a provider like CCV for the payment terminal:

Checklist:

- Reliable

- Simple to use

- Mobile or fixed?

- Pay a monthly fee or a one-time cost?

- Why Don’t you use our free terminal configurator to find out what is the best payment solution for you? Currently available in Switzerland and Germany.

- A contract with the acquirer so you can accept card payments:

Before you can start accepting payments, you need to sign a contract with your acquirer, who creates or maintains the merchant’s bank account.

Checklist:

- low transactions’ feese. the amount charged to you each time a communication happens. At CCV, we can offer you very competitive rates!

- Paper rolls (for receipts if applicable)

To wrap up what you want the process to be fast and efficient.

Why don’t you contact us to discuss what the best kit for you is? We would love to help you with the practicalities.